michigan sales tax exemption rolling stock

Direct Pay - Authorized to pay use tax on qualified transactions directly to the State of Michigan. Jud Gilbert R on February 28 2012.

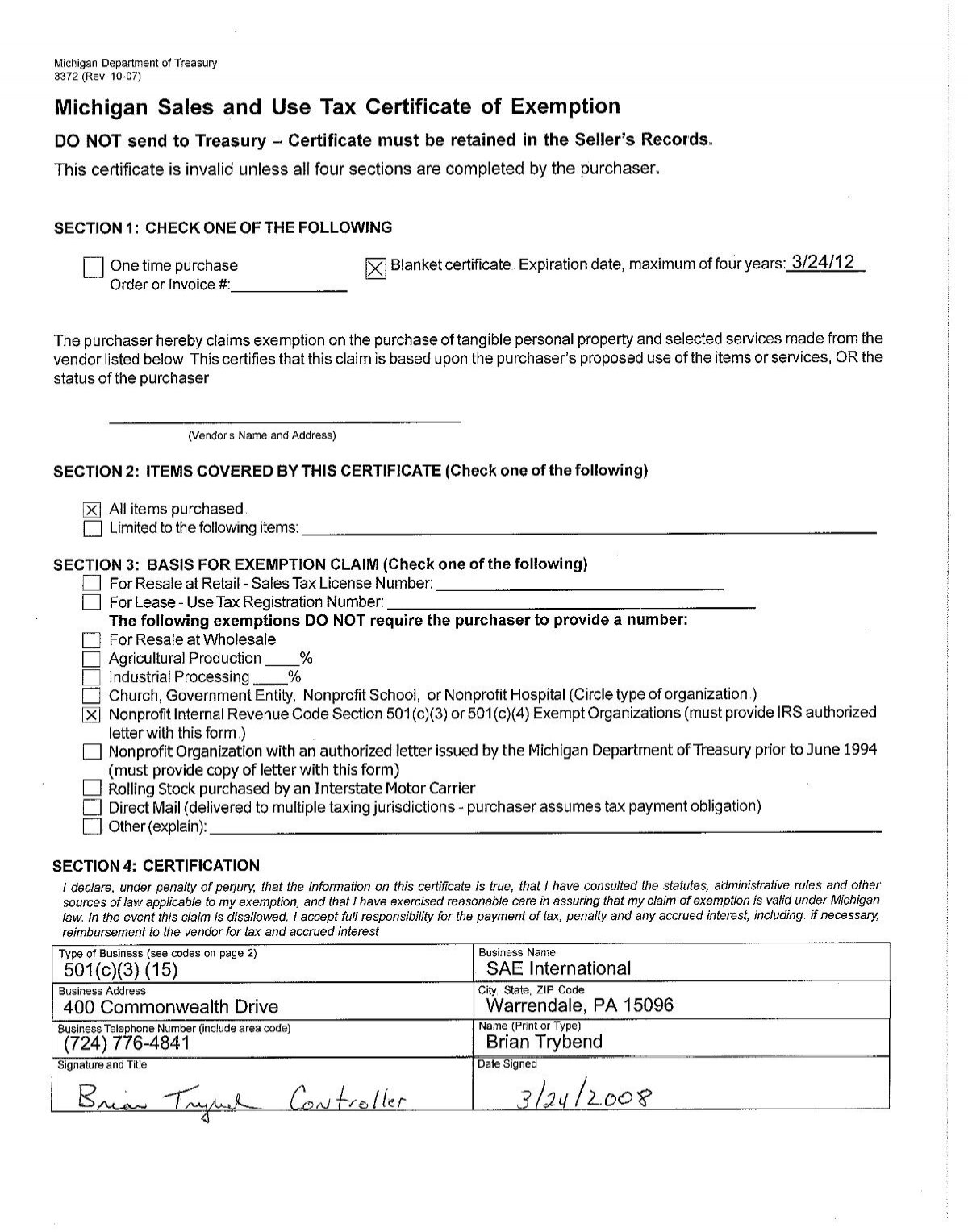

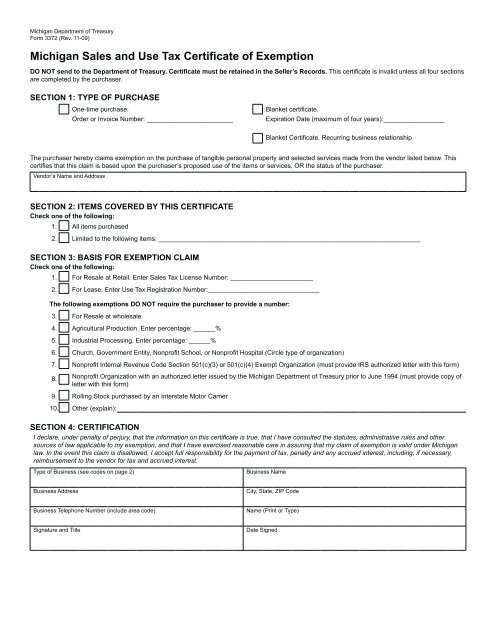

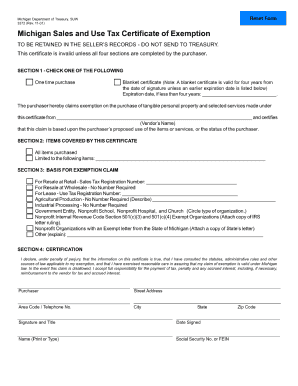

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

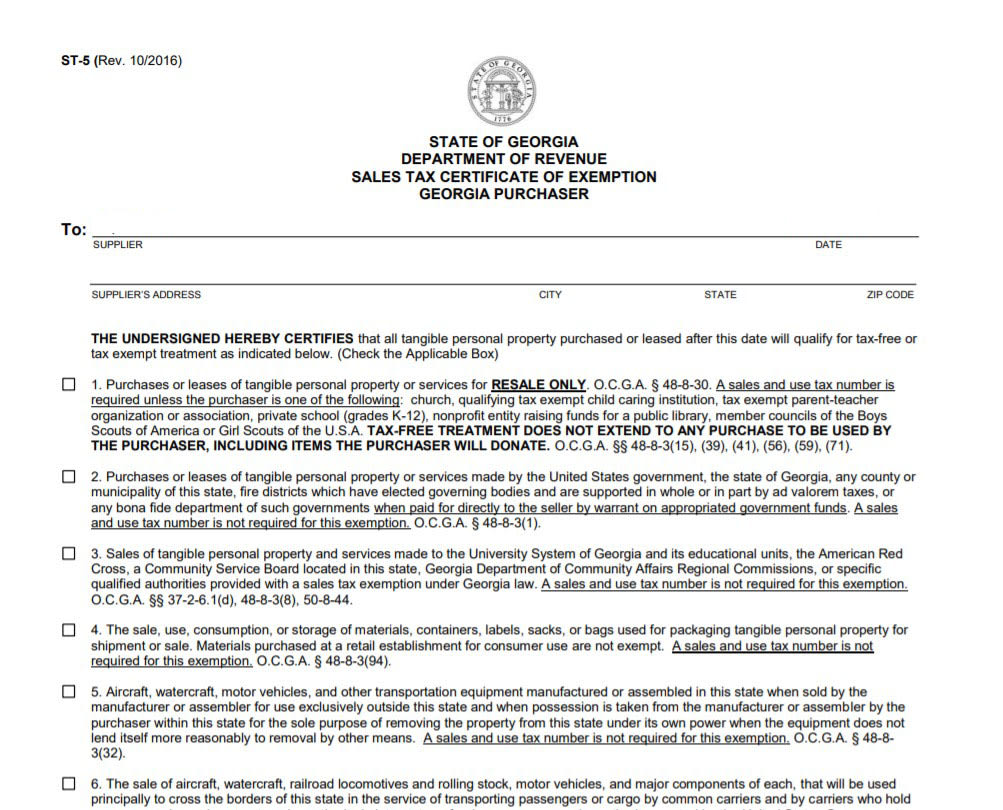

Web For other Michigan sales tax exemption certificates go here.

. Web In 1985 the state began providing interstate motor carriers domiciled in Michigan with a refund of sales and use taxes paid on rolling stock used in interstate. Definitions 1 All of the following are exempt from the tax under this act. See Michigan Laws 20551.

Web Section 20554r - Qualified truck trailer or rolling stock. Web While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Web Michigan provides a sales and use tax exemption to interstate fleet motor carriers for rolling stock and parts affixed to rolling stock that are purchased rented or leased by an.

1 All of the following are exempt from the tax under this act. Otherwise this exemption would have ended on May 1 1999. Web Up to 2 cash back 10 I Rolling Stock purchased by an Interstate Motor Carrier.

Web tax exemption for rolling stock purchased rented or leased outside the state by interstate truckers. Includes a tax interest or penalty levied under this act. This page discusses various sales tax exemptions in.

Web See Michigan Laws 83o. Nonprot Internal Revenue Code Section 501c3 501c4 or 501c19 Exempt Organization. Web Rolling Stock purchased by an Interstate Motor Carrier.

Qualified Data Center 12. Web 2012 House Bill 5444. Nonprot Organization with an authorized letter issued by Michigan.

Web Senate Bill 544 S-1 would amend the General Sales Tax Act to exempt from the tax sales of rolling stock purchased by an interstate motor carrier and used in interstate. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and. 111 I Qualified Data Center 12 I Direct Pay - Authorized to pay use tax on qualified.

A The product of the out-of-state. Public Act 467 of 2012. To expand a sales.

Expand rolling stock sales tax exemption.

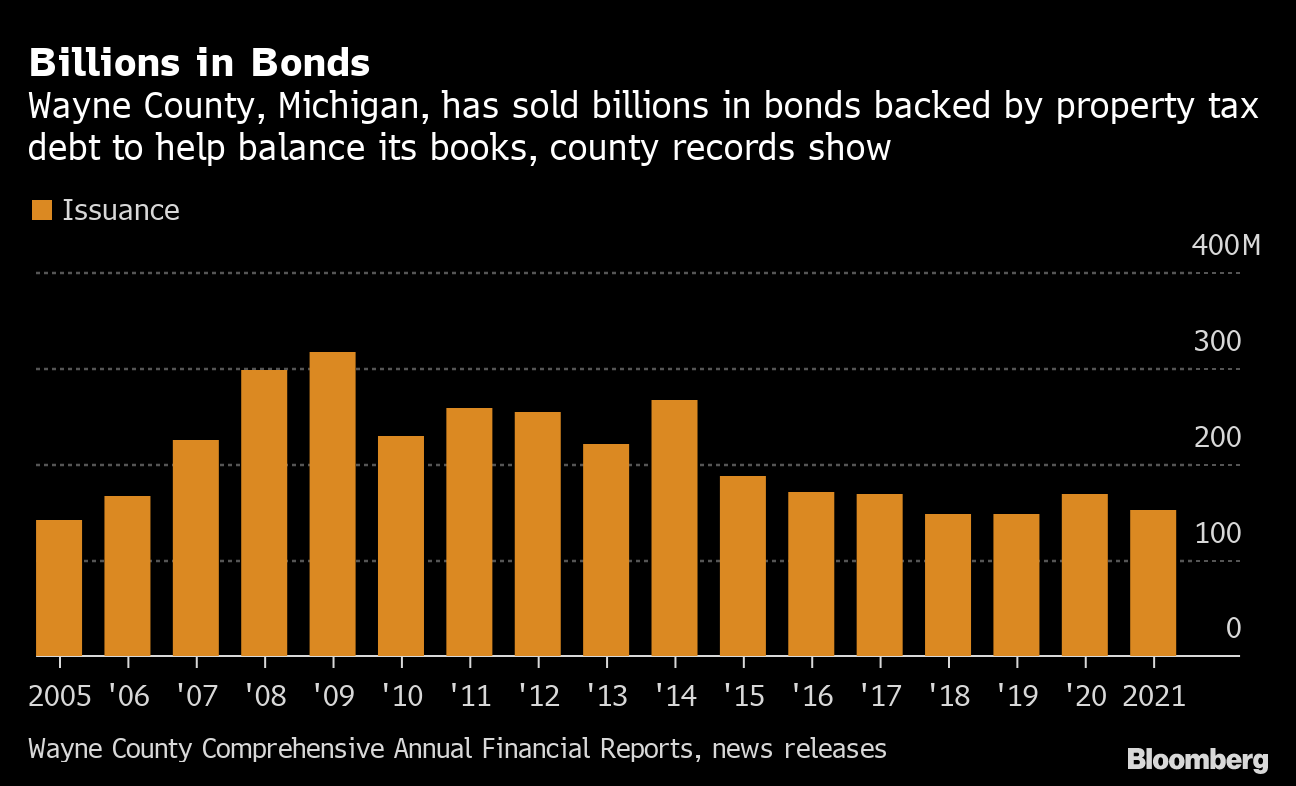

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

Dealer Manual State Of Michigan

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Dallas Dart Transit Pricing Taxable And Tax Exempt Bonds Bond Buyer

Mi Sales Tax Exemption Form Animart

Unlimited Taxes And More Inc Michigan

Michigan Sales Tax Small Business Guide Truic

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Customer Forms Lasting Impressions

News Fort Wayne Railroad Historical Society

How To File And Pay Sales Tax In Michigan Taxvalet

Irs Form 3372 Fill Online Printable Fillable Blank Pdffiller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Sold Price Lionel 6 8667 Amtrak Alco B Non Powered Dummy Unit 4 Amtrak Passenger Cars Lake Shore Limited Add On Items April 6 0121 1 00 Pm Cdt